ASPPA/NTSSA “Study” Rebutted With Own Example – Claims Defamation

ASPPA/NTSAA continues to submit a white paper titled “ “Protecting Participation: The Impact of Reduced Choice on Participation by School District Employees in 403(b) Plans” to school boards and state legislatures across America (including recently in California, where I live), despite it being shown (by me and now others) to be biased, misleading and containing assertions not supported by facts.I have detailed my issues (opinions) with the study here and you can see all of what followed at my sister blog http://teachersadvocate.blogspot.com.There have been other refutations since mine came out, but the one I’ve posted below is special because it is written by the consultant to one of the employers mentioned in the ASPPA/NTSAA study – Jefferson County, CO – JeffCo Public Schools.In my refutation I mentioned many reasons for potential drops in participation that have nothing to do with changing provider structure, they were:

Participants retiring – how many of those participants retired? Given that the percentage of participants who are older is usually much higher than the percentage of participants who are younger, people retiring would have a larger affect on participation rates.

Layoffs. I’m sure no one who was contributing to a 403(b) was laid off during this time period.

Other retirement plans. School employees also have access to a 457(b), how many switched to contributing to a 457(b) instead of a 403(b)? I happen to know of a county in Southern California or two that actively pushes to get participants into their 457(b) plans at the expense of participation in 403(b) plans. How many of these participants stopped contributions to a 403(b), but started to a 457(b)?

Greatest financial collapse since the Great Depression happened during this time frame – could that have an effect on participation?

Greatest housing collapse since the Great Depression was occurring during this time frame – could that have an effect on participation?

Other reasons for lower participation after a switch could be poor communication during the transition or requiring participants to re-sign up for a 403(b) as opposed to allowing contributions to continue to the new provider without a new salary reduction agreement. A full study that included employers where participation stayed the same or increased after a reduction would be helpful for everyone as it would help create a “best practices” for transitions of this sort – the ASPPA study was not designed to address such questions.

While each of my reasons above could be likely factors for potential drops in participation, it turns out that one in particular accounted for much of the drop, yet was not mentioned in the ASPPA/NTSAA study – the addition of a 457(b) plan. In the letter below, the consultant states:

“At JeffCo Schools, in point of fact, the number of contributing participants in their retirement plans have been unchanged from 2005 – 2011. JeffCo Schools rolled out a 457 plan option on January 1, 2006. Because of more attractive distribution options, many participants chose to switch to a 457 from their previous 403(b). The ASPPA study ignored this fact. Even with attrition from the 403(b) to the 457, 403(b) and 457 plan participation in 2011 was 4,243 from 4, 262 in 2005.”

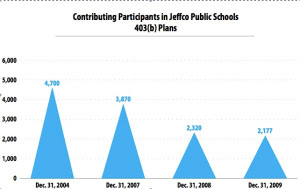

ASPPA/NTSAA chose to illustrate the JeffCo example with the following info graphic:

This graphic clearly demonstrates falling participation – yet it also fails to capture the entire story and turns out to be very misleading when put into full context – at least according to the data provided below from Innovest and JeffCo Schools.

One must ask, what has happened to ASPPA/NTSAA? I’ve spoken to many members who are disappointed with this sad turn of events for what is (was?) a great organization. The zeal to protect a 403(b) industry stuck in the past has blinded them to the reality of the day.

Regardless of ASPPA/NTSAA’s reasoning to release a study that they knew or should have known to be misleading (this is my opinion), the study should not be taken seriously. It is time that ASPPA step up and withdraw the study and stop distributing it to unsuspecting school boards and legislators.

Who at ASPPA/NTSAA will step up and finally say what the members are thinking? Perhaps this devastating letter provided below will be the impetus.

ASPPA/NTSSA has responded to the below letter with a bizarre post on their blog, which targets yours truly, titled “Supporters of California Bill Attempt to Defame Study”. In the post they claim:

Supporters of the bill are attempting to bolster support for the bill by defaming a 2011 study on participation in 403(b) plans. Correspondence was sent to the the Honorable Jose Solorio of the California General Assembly by INNOVEST and Scott Dauenhauer (the “Bill Supporters”) which challenges the validity of the study.

Innovest never sent the letter to me directly and has never communicated to me that they were even sending a letter. Until the letter became public record I did not know it existed. Having said that, I do support the right for employers to bid their 403(b) plans (just like they have this right for their 457(b)) and the rights of employees to have fiduciary based retirement options and this bill takes steps toward that end.

As I detailed above and on my sister blog, I thoroughly discredited the ASPPA/NTSAA study with objective facts, no defamation. The Innovest letter goes further by using ASPPA/NTSAA own example and providing the full context (and data) to demonstrate that the ASPPA/NTSAA got it wrong (or at least didn’t provide the full story). Innovest used data, facts and context to discredit that portion of the “study” – they never attacked the people who wrote it personally or resorted to statements that were knowingly false.

Defamation is a strong word – the proper term here is discredit. I believe that both Innovest and myself have discredited the “study” using logic, context and facts – no personal attacks. I honestly believe the study is flawed and could never be accepted by scholars or allowed in a scholarly journal. I’m fully prepared to withdraw my claim of “discredit” if ASPPA/NTSAA can get their study published in a reputable scholarly journal.

ASPPA/NTSAA states:

The claims made in the Bill Supporters’ letter are baseless and unfounded. The Bill Supporters accuse the authors of the study of omitting data for the Jefferson County School District in Colorado, without providing any evidence substantiating their claims. Furthermore, the Bill Supporters’ letters fail to address that the study found similar reductions in participation in California and Pennsylvania when retirement savings options were eliminated for those participants.

I’ll let you read the letter below and decide who is telling the truth, it becomes rather obvious.

Scott Dauenhauer CFP, MSFP, AIF