Conflicts In Fixed Annuities: Incentives - Part I

Our nation's school employees are subjected to insurance salespeople everyday touting the newest and greatest fixed annuities. I decided to start a regular column called Conflicts in Fixed Annuities in order to highlight the problems I see.

One evening while googling 403(b) terms I came across incentives schedules, commission schedules and all sorts of interesting information from annuity companies that service school employees. All of it out on the open internet (not locked behind a firewall) for anyone to see.

This first post deals with "incentives" as they relate to how an agent might be paid for selling different variations of a single product. There will be several parts to the "incentives" portion of this regular column.

The Incentive to Sell Longer Surrender Period and Higher Surrender Charge Annuities

When trolling around on the internet I came across several documents posted by companies who wholesales fixed annuities (they service insurance agents who service participants).

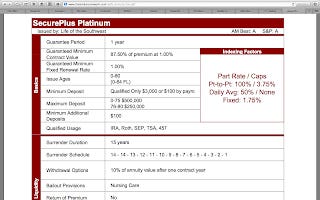

You can view one of the documents here, until they take it down, which I assume will be soon (I'll also post at the end of this column a screenshot to prove it was not behind a firewall).

I took the pertinent information from the document and created the following chart:

The information is from a National Life Group/LSW product chart document put out by an insurance marketing organization, but the company is not important for this post, nearly all insurance companies sell annuities in the manner I'm about to describe.

What the above chart shows is the product, its first year commission, the charge for withdrawing funds in the first year of ownership and the surrender period (how long you must wait to be surrender charge free). Note: The surrender charge goes down by 1% each year until it hits 0%.

My intention is not to discuss the merits of the products, simply the compensation offered as it relates to the surrender options.

The key takeaway is the insurance agent has a choice to earn a 4.5%, 6.5% or a whopping 10% commission. The choice is pretty simple, especially if you have a mortgage payment to make. Selling the "platinum" product pays the agent 122% more commissions than selling the "silver."

In every day life, if given the choice between silver, gold or platinum, which would you choose? Platinum of course, why settle for silver when you can have the better, rarer metal!

Never mind that the participant ends up being stuck in this product for an additional 8 years (if they are sold platinum over silver) and that the withdrawal charge is 7% more in the first year - they now have platinum status!

It appears the agent is incentivized to sell the product that will make the insurance company the most money. Why sell a 4.5% commission product when you can sell a 10%? If an agent only sold a product that had a 10% commission and aimed to earn $150,000 per year, they would only need to place $1.5 million in annuity premium each year (or about $125,000 per month). To earn the same income selling the 4.5% product the agent would need nearly $3.5 million in annuity premium.

Perhaps now you understand why teachers are a fertile recruitment ground for insurance companies. A teacher earning $60,000 plus benefits could switch careers to selling annuities and would need to sell less than $1 million in annuity premium annually - a pretty simple task - in order to make more money and have more free time (not to mention less stress).

You might remark that if the agent sells the silver product they would have the opportunity to sell another annuity in 7 years and get another commission. True, but this assumes the agent still has the client and that rates make sense enough to replace the original product.

Do the math, of these three products the agent makes more money on an annual basis (and all upfront) by selling the platinum over the gold or silver. If you divide the 10% commission into the 15 year surrender period for the platinum the agent makes on average .67% annually, it falls to about .65% for the other two. Would you take a guaranteed .67% for 15 years or a non-guaranteed .65%?

Even IF the agents always chose the silver (we'll get into other conflicts in future columns) option, the fact that insurance companies offers incentives to attempt to get agents to sell what are likely more profitable products is a major conflict of interest. Trusted advisors should NOT be paid more to recommend one product over another.

This has to change, agents should not be able to make additional compensation for selling longer surrender period/higher surrender charge products. Disclosure is not enough, in fact it is a smokescreen to hide conflicts like the one outlined above, elimination of conflicting sales incentives must happen in order to protect our nation's school employees retirement.

Scott Dauenhauer, CFP, MSFP, AIF

President

Meridian Wealth Management

@403badvocate

www.meridianwealth.com

Screenshot of Firewall Free Document