Phishy 403(b) Food Chain

Ever Wonder Who Benefits From Those Phishy E-Mails? Don't Take The Bait.

Ever wonder about the economics behind the e-mail solicitations you get in your email?

Educators know the e-mails I’m talking about; unsolicited messages disguised as your employer or retirement system, but in reality, it’s a trojan horse to a sales pipeline that makes everyone money but you.

There are generally three parties to these e-mail campaigns.

The three parties that make up the food chain are the lead generation companies, the agents that purchase the leads, and the insurance companies that benefit from the business the agents’ place with them. We don’t want to imply that all e-mail marketing is bad, but we’ve seen an uptick during the pandemic of very “phishy” messages. They only need to get a few bites per batch of e-mails sent to be profitable, and too many educators are taking the bait. Those clicks are costing educators millions of dollars.

Lead Generation Companies

These elusive companies come and go, often started and dissolved in short periods of time. Some of these companies are the same ones who would put flyers in your boxes or send “free pension estimate” mailers to your home. Below is an example sent to my wife last year; she receives them multiple times a month.

The lead generation company is designed to create separation from the method a lead is generated and the agent following up on the lead. Since the insurance agent or broker who buys the lead is not doing the actual marketing, they can claim that they had nothing to do with how false the marketing appeared; they were simply “purchasing and following up on leads.” This purposeful design also creates space between the end insurance company (usually an insurance company pushing indexed annuities and indexed universal life insurance). The insurance company and agent can plead ignorance (and they do).

This is not to say the insurance company doesn’t know how these leads are generated. They prefer plausible deniability.

Insurance companies and agents are highly dependent on these deceptive e-mails for new business, especially during the pandemic.

Insurance Agents, Brokers, and FMO/IMOs

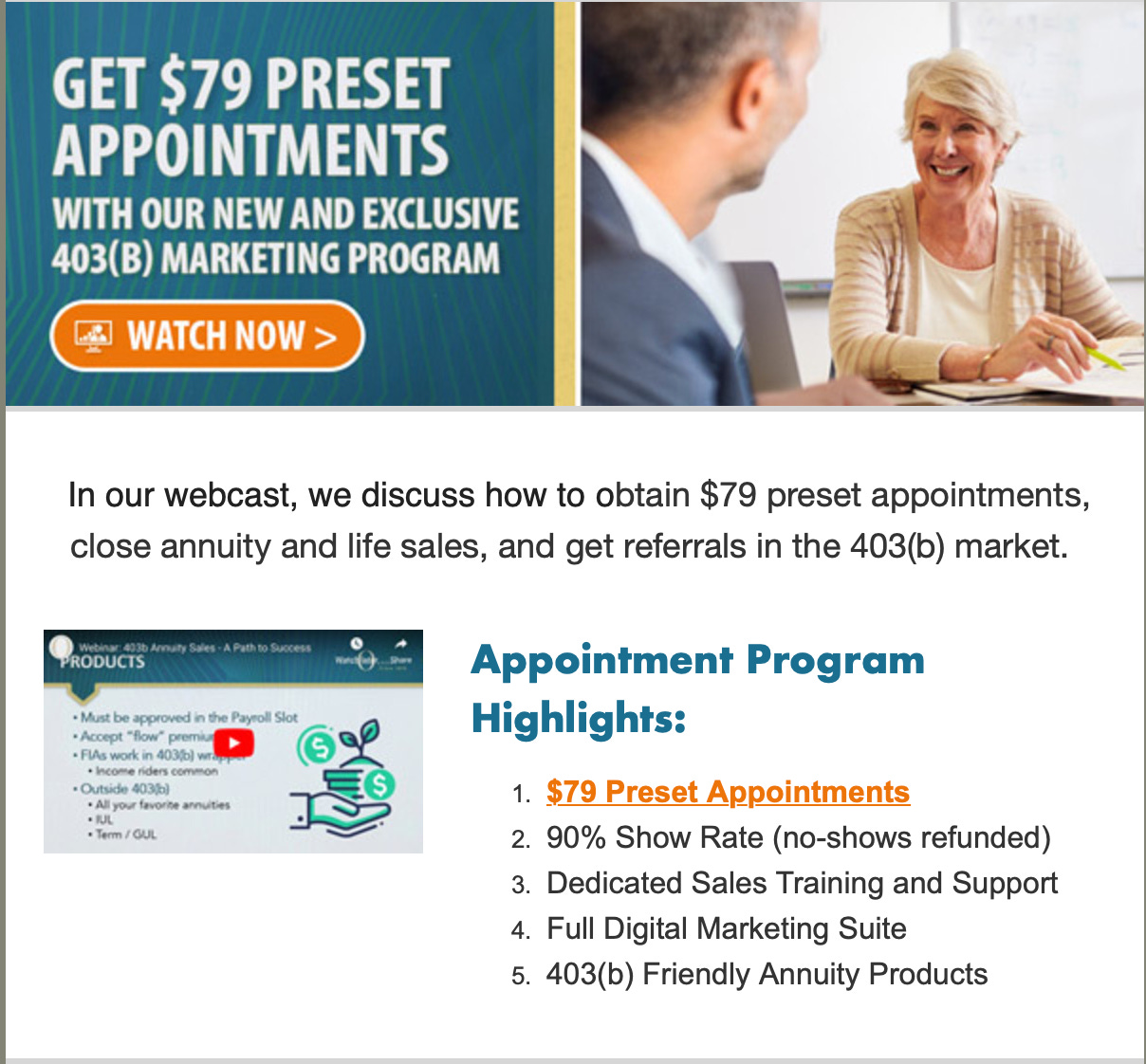

While the lead generation companies do find fresh victims, they often are not licensed to sell any products. They generate leads and sell them to insurance agents, brokers, or Insurance Marketing Organizations. These leads can vary in cost, but at least one marketing company charges $79.

Notice in the featured YouTube video that the goal is not just to sell you Indexed Annuities inside your 403(b), but to also sell them outside your 403(b) along with Indexed Universal Life insurance (huge commissions). These $79 leads are generally set through deceptive e-mail marketing.

Occasionally (especially with 403(b) in California), the lead generation firm is licensed as an insurance agency. The price of the lead is a commission split with the agent or broker. This method is becoming increasingly popular.

Insurance Companies

Many 403(b) vendors send their own e-mails. They correctly identify who they are and what they are selling; these e-mails are still spam if not approved by the district or if you haven’t permitted them to contact you.

Many companies will send out mass e-mails to district employees where the vendor is on the approved provider list. They will obtain the e-mails through screen scraping or by purchasing the lists from list brokers or associations that employees belong to (or by sponsoring conferences education employees are likely to frequent). These e-mails are often unsolicited and misleading (being an approved vendor is not the same as being endorsed), but given their regulator (usually FINRA and or SEC), the e-mails do a good job identifying who is sending them and allow you to unsubscribe.

Other 403(b) vendors (usually indexed annuity distributors) do not directly send out e-mails but are huge beneficiaries of the lead generation e-mails. They benefit from the separation between the lead generation company and the so-called “independent” insurance agent who seems only to sell one particular insurance company. They will claim that they have nothing to do with the e-mails being sent but benefit from massive flows into their products from these agents. They know the e-mails are going out and, in some cases, have exclusive arrangements with the lead generation or insurance agents, which are not disclosed. One prolific insurance company is the only “preferred vendor” on one lead generation website. This company is fully aware of how the policies they are writing are being sold, but they make so much money, they don’t want to turn off the hose.

Compliance Administrators

This one might surprise you. Some companies that administer retirement plans for public school districts are just fronts for product sales. One company out of California, TDS Group, outsources the compliance piece to another company while using its influence to push low-quality 403(b) products. TDS also is a notorious e-mail spammer. Below is one version my wife has received dozens of times from TDS (see this article about TDS Group CEO).

…and it turns out that those phishy e-mails might have been a front to a stock scam set up by the CEO of TDS, Robert A. Lotter.

Lotter was arrested on 60 counts of securities fraud and allegedly used the data from phishy emails respondents to determine who had enough money to push fraudulent securities on them. According to news stories, teachers made up a significant portion of the fraud.

Stop Phishy e-Mails

It’s time we put an end to these slimy sales methods once and for all. If you are sent one of these e-mails, please forward it to phishy@403bwise.org. We are working to build a national database of e-mails and working with local, state, and national regulators to shut this type of lead generation down.