Equitable (formerly AXA) announced last year they were under investigation by the SEC regarding their sales and disclosure practices. This year they announced they were close to a settlement with the SEC.

But what exactly are they settling? What are the allegations?

We can’t say for sure, but there were hints in Equitable’s 12/31/2021 10-K filing.

First, the filing only discloses information about one allegation, but there are others. We know there are multiple allegations of misconduct because Equitable tells us as much when they stated, “If approved, under the settlement, the Company would neither admit nor deny the allegations…”.

The one allegation Equitable refers to is a bit cryptic. The wording of their 10-K filing attempts to downplay the allegations and make the SEC appear too sensitive. Equitable makes the disclosure look like they are being the “bigger person” and acquiescing, but only to satisfy the regulator. I think the allegation they refer to is much bigger than they lead on. I want to clearly state I do not have any access to what was alleged or what was settled (or perhaps is still being settled). This is my speculation based on my knowledge of Equitable/AXA and their words in the disclosure. Until we have a press release from the SEC, there is technically no settlement.

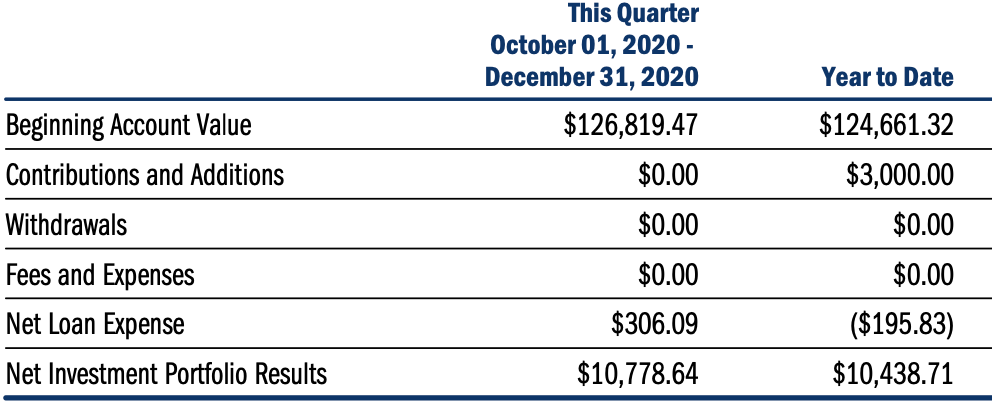

The seemingly dull sentence Equitable wrote in their filing may be just enough to reveal the allegation, but only if you’ve reviewed an Equitable statement before. The picture at the top of this blog post has a snippet of an Equitable statement. Scroll back up and check it now.

After reviewing the picture, consider the following statement from the filing:

“…the allegation that daily separate account and portfolio operating expenses disclosed in customer prospectuses and incorporated in the calculation of net investment portfolio results in quarterly account statements were not properly presented or referenced in those account statements.”

You may not realize it, but mutual funds and variable annuities are not required to disclose certain expenses on their statements. Instead, the fees are disclosed at the time of purchase and annually via a disclosure table included near the front of a prospectus. You won’t find all your fees categorized and summarized by the actual dollar amount on your mutual fund or variable annuity statements (though you will find some fees - such as flat fees, surrender fees, loan/hardship fees, living benefit fees, for example). Most investors have no idea they are paying fees because those fees are hidden in a prospectus and not disclosed on the front page of their statement.

You’ll notice that Equitable has a line item on their statement (the above picture is from page one of a statement) that says Fees and Expenses. It is entirely reasonable for the average American to think that if that box is Zero, they didn’t pay any fees during the statement’s covered time period. It would be weird to have a line item on the statement that said Fees and Expenses and then not have it contain ALL the fees and expenses.

It’s entirely reasonable for Equitable/AXA participants to think they did not pay any fees at all when they see goose eggs next to a line item that says Fees and Expenses.

Read the allegation one more time:

“…the allegation that daily separate account and portfolio operating expenses disclosed in customer prospectuses and incorporated in the calculation of net investment portfolio results in quarterly account statements were not properly presented or referenced in those account statements.”

As I mentioned, daily separate account and portfolio operating expenses are not currently required to be disclosed on the statement (only in a prospectus), and Equitable does not disclose them. However, by including a line item on their account statement that says “Fees and Expenses,” participants reasonably believe those fees and expenses ARE being disclosed, and the cost is $0.

If I’m right, we should expect to see changes to the statement, but not how you think or hope.

It’s doubtful that Equitable will start disclosing their daily separate account and portfolio operating expenses on the participant statement (though I think they should, as should everyone). Instead, I anticipate they will remove the Fees and Expenses line or add a footnote that points to tiny print somewhere else on the statement that will then disclose that not all fees and expenses are being disclosed on the line item that says fees and costs.

As for what the other allegations are, it’s hard to say as they don’t provide any more clues.

I hope that the SEC deals with Equitable’s mass email spam program (though I doubt this given the fact my wife still receives Equitable spam regularly), as well, as some agent’s claim that their structured products are somehow akin to index funds and have no fees. Having no fees is not the same as not having costs (that’s another blog post). We will have to wait and see what the SEC has included.

While I admire the SEC for going after Equitable, the idea that a company that did something wrong can pay a fine and not acknowledge they did something wrong will always bother me (...neither admit nor deny…). Either way, you don’t settle allegations for $50 million when you did absolutely nothing wrong. That’s my opinion, at least.

If you want to hear Dan Otter and myself talk more in-depth about the upcoming Equitable settlement, you can listen to our latest Teach and Retire Rich podcast here or by downloading your favorite podcast app and heading to episode 208.

If you have yet to listen to our newest limited series podcast, Learned by Being Burned, find it on your favorite podcast app or here.

https://www.gao.gov/assets/ggd-00-126.pdf