Top 403(b) Providers In Major School District Still Have 18% Surrender Charge

The following is my professional opinion as an Independent Fiduciary:

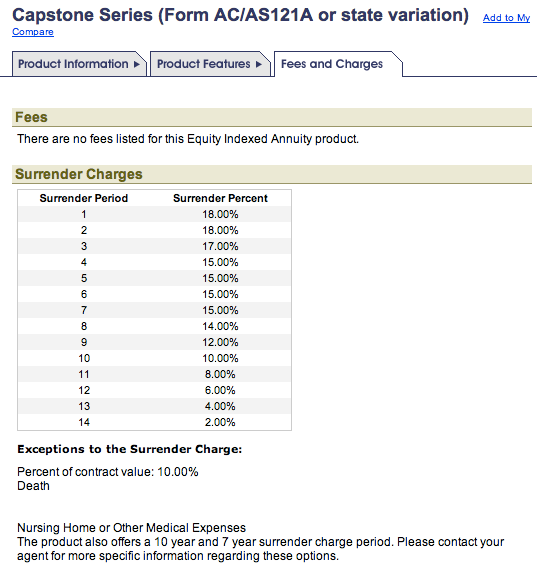

403bCompare screenshot Midland Surrender Charge

Would you believe me if I told you that two of the top providers of 403(b) products in a major school district offered products that had surrender charges as high as 18% and surrender periods as long as 14 years? I'm still in shock myself (and that takes a lot to do).

Midland National Life offers a product called the Capstone in California and it has a surrender period of up to 14 years with a surrender charges of up to 18%.

Life Insurance of the Southwest, part of the National Life Group offers a product called the SecurePlus Platinum (how's that for a name) that has a 15 year surrender period and surrender charges of 14%.

These two companies are not small providers, they are the top two by assets.

This is what educators get when school employers are not allowed to control their 403(b) programs. These products would never fly in an ERISA plan and would never be sold by a fiduciary, yet everyday school teachers are sold products with excessive surrender periods and excessive surrender charges.

These are the products that ASPPA's sub-association, the NTSA fight to keep available to our nation's school employees. This is wrong.

You can check the products out on 403bCompare by clicking on the company name above.

Scott Dauenhauer CFP, MSFP, AIF